The Loudon Investment Management investment philosophy focuses on long-term value investing with above average current income and below average volatility. Our portfolios do not look like the overall equity “market” and often not like typical balanced portfolios either. While holdings are spread across a number of market sectors, our portfolios have a point of view which reflects our perception of where value is currently most available in the market place. We are believers in unbalanced diversification.

Value

In both investment portfolios and client relationships

March 2020 Quarterly Update

April 13, 2020

Dear Clients and Friends:

Re: Q1 Review

What a way to start the year! It began well enough, moving some 5% higher on top of the S&P 500 31.5% return last year. Then Covid-19 began to catch hold. And that was followed by an oil price war between Russia and Saudi Arabi. While a lower price for gasoline is appreciated by all, too much of a good thing puts oil companies out of business adding to the layoffs already related to the virus. So far only one oil company has gone bankrupt though more, fracking companies in particular, are likely to follow.

But Coronavirus was the main show, resulting in numerous business shutdowns, skyrocketing unemployment, and likely a recession before the end of the year. However, how long it will last is an open question. Our own belief is that those who think we will have a decline in growth followed by a sharp snapback in the fourth quarter seem to have blinders on.

These events are likely to have a psychological effect for some time. Everyone comes out the other side of an event like this more cautious than they were before it started.

Having said that, the market might have done worse, given the huge disruption to both our day to day lives and the economy.

|

Benchmark Index Returns |

YTD Ending |

|

Lipper Balanced Fund Index |

-12.90% |

|

S&P 500 Stock Index |

-19.6% |

|

Russell 1000 Value Index |

-26.70% |

|

Bloomberg Barclays 1-3 Month T-Bill |

-0.74% |

|

S&P-7-10-Year-US Treas. Bond Index |

10.31% |

|

S&P U.S. Gov & Corporate 20+ Year Bond Index |

9.29% |

While each of our letters reviews what has recently happened quarter by quarter, the financial markets pay little attention to such artificial time frames. More realistically, we should look at the stock market returns within the context that we have just come off a very very good year. As we explained in our recent interim note, this was a true black swan – no one could have seen Covid 19 coming and therefore, no one could have fully prepared in advance. This and the huge computerized and derivative trading base we have today resulted in a very sharp decline in the market (down more than 30% top to bottom) followed by a one-week improvement near the end of the quarter. To add to the above, we also started the decline with historically high valuations that have concerned us for some time. Even at its low, many stocks were by no means “cheap”. Today we are again above the long-term historic average price earnings ratio. We do believe that at some point high valuations will be fully rectified. Maybe when the economic reports and corporate earnings really turn sour as they will over the next several quarters.

In the meantime, the market has recaptured about half the total decline.

On the other side, bonds (and government bonds in particular) did very well. The Federal Reserve moved quickly to push money out into the system and took several other steps to ensure there was plenty of liquidity. Not surprisingly, there was also a flight to quality and safety as some of the money that left stocks went into bonds rather than cash. Finally, foreign demand for Treasuries continues to be high. All of these factors pushed bond prices higher and interest rates lower.

Technically, we entered a bear market when the decline exceeded 20%. However, in our experience, a bear market is as much psychological as it is numerical. And that is why recovery often takes considerably longer than the decline. Of course, people who own stocks are immediately shocked at how much their investments are down. But if there is a real recession and it grinds on for a while, the angst will spread across the economy as jobs disappear and lower stock prices start to feed on themselves.

That is why, though we stated in our last note that we might begin to nibble on some stocks, we haven’t done it. In the midst of free fall, the best thing to do is generally nothing as it is too easy to sell the “losers” low only to find that what was purchased with the proceeds in turn also become losers. And net selling to raise cash in a period like this requires that you also know when to get back in the market. Already, those who did some panic selling at the bottom have left a fair amount of money on the table. Yet with psychology still poor, buying is very difficult to do. So, we wait. We know that no bell will ring when it is time to start buying, but in this environment, we prefer missing some opportunity rather than take the risk of a further significant further step down as bad numbers will begin to pour in.

Top 20 Holdings

|

3M Company |

Fastenal Company |

|

AbbVie Inc. |

Illinois Tool Works Inc. |

|

Aflac, Inc. |

Intel Corporation |

|

Ameriprise Financial |

Lowes Companies Inc |

|

Amgen Inc. |

Microsoft Corporation |

|

Archer Daniels Midland |

PepsiCo Inc. |

|

AT&T Inc. |

Pfizer, Inc. |

|

Cisco Systems, Inc |

Qualcomm Inc. |

|

Emerson Electric Company |

Starbucks Corporation |

|

Enterprise Products Partners L.P. |

V.F. Corporation |

Over the turbulent first quarter we saw three companies come off our top twenty list, all based on poor price performance – Leggett & Platt, Polaris, and Ventas. Of these three, we have a good deal of confidence in Leggett & Platt and Polaris to come back despite both being highly cyclical companies. While the likely recession does not bode well for immediate purchases of new furniture and mattresses and the springs that Leggett & Platt makes that go in them or new ATV’s and snowmobiles (Polaris), these companies have weathered many storms in the past and come out all right on the other side. Leggett & Platt has raised its dividend for 48 years straight, while Polaris has raised the dividend for each of the last 25 years. While the immediate future may be tough going, we believe their businesses will come back and the current discount prices have fallen too far given the strength of their balance sheets and long-term fundamentals. We believe that both will continue paying their dividends which is a large reason why we intend to hold tight for now. In fact, we might consider buying more once it is clear that the worst has passed. We are keeping a closer eye on Ventas, which did cut its dividend in the turmoil of 2008-2009, though following that period, a concerted effort was made to upgrade their portfolio. Ventas holds over 1200 properties focused on senior housing, skilled nursing, medical office buildings, and life science. While the latter two are not of great concern, even with an aging population, it is uncertain whether the Coronavirus will have a lasting impact on senior housing facilities. We are not overly concerned at this point and believe the stock has fallen too far, too fast. Nevertheless, this is a company we are watching more closely.

Companies that have come onto our top twenty list this quarter include PepsiCo, 3M and Lowes. We have not purchased any recent shares in long term holding Pepsi, but the company has held up much better than the overall market which earned it a spot on the list. 3M had performance just about in line with the market for the first quarter and we have slowly been adding shares, largely around the end of last year. While not a significant portion of the business, the company has been in the news recently as it is one of the largest producers of N95 facemasks and the company is in the process of doubling its production to 100 million masks per month (35 million of these will be made in the US). The company is in excellent financial shape and has increased the sizeable dividend for each of the last 62 years, currently paying us a generous 4.3% yield while we wait for any recovery. 3M’s stock price had been cut quite a bit even before the recent downturn due to concerns about its potential liability for PFAS chemicals that used to be present in many of the company’s products such as Scotch Guard. It has been out of the PFAS business for over ten years now and is known as being particularly environmentally sensitive though lawsuits over PFAS continue to linger.

Meanwhile Lowes is another company we have continued adding shares to this year, another dividend king which has raised the dividend over each of the last 57 years. The company should see moderate growth over the next few years. As of now home improvement stores have seen a bump in sales as many are utilizing the time at home to catch up on home repairs and maintenance. We expect this may slow down eventually if consumer spending dries up. However, it is a business that should fare well over the long term, has only limited competition from online sellers and it is trading at a very reasonable price. In addition, the stock is selling at the highest yield we have seen in decades, now paying out 2.5% based on the current price.

What we own

As we look at the Top Twenty holdings in aggregate, we see a very high-quality list of stocks from a number of perspectives. They all pay reasonable and, we believe, safe dividends. Most have also been increasing them regularly for many years. Balance sheets are also strong with limited debt relative to their ability to pay the interest when due. These factors, and more, indicate to us a desire to share success with shareholders and work toward the kind of consistent results that allows us to refer to them as “good companies”. In fact, a number can be referred to as “best in class”.

Over the past year in particular, we have been working portfolios in this direction. This was because we were worried about what we regarded as overly high valuations and the potential for a major problem, though we never envisioned it would be a virus.

Price alone is one of the factors that constitutes risk. A great company can also be at high price risk when its valuation is very high just as surely as a poor company represents high fundamental risk in a recession. As a result, we are quite sensitive to the value contained in the stock price at the time of purchase, just as much as the quality of the company.

When the market is roaring higher no one much notices a company’s shortcomings, but when something bad happens all of a sudden, the distinction between good or strong versus weak or bad becomes quite apparent. Or as Warren Buffet has said, “It’s only when the tide goes out that you learn who has been swimming naked”. The power of the companies that have strong balance sheets and superior cash flow will lead our portfolios out of the recession.

Some negative surprises should be expected in individual stocks regardless of pedigree, but so far, we have been able to avoid most of the worst, at least in terms of fundamentals.

Maintaining Perspective

When a crisis hits, it is very difficult to keep things in perspective. The stock market in particular is not very good at looking past the problem. The Coronavirus has been worse than most as it was a complete surprise so the market had no ability to prepare. It also contains many more unknowns than a typical precipitating event, making it even more difficult to understand in terms of long-term fundamental impact.

But in the stock market, the appearance of what are thought to be crises are fairly regular events. Bad news is often over reflected. This has been especially true over the last decade as the volatility and pace of trading has risen exponentially since the stock market bottom back in 2009. In that context, how should we properly view what has happened over the past two months and what should we do about it?

Last week, the stock market recorded one of its best on record, as it rocketed 12% higher. With this, the market has recovered just under half the points lost in the total decline. It is now down about 17% from the peak in early February. So where do we go from here?

Given some preliminary signs that the spread of the virus has now slowed, some portion of the rebound was probably justified. However, we are less optimistic about the fundamental outlook going forward. The economy and corporate earnings will not just immediately bounce back. At a minimum there will be a significant change in investor/speculator confidence. Before the decline, there was almost a bubble in positive sentiment. This will be slow to return as caution will prevail suggesting slower economic growth for some time.

Some stocks, technology in particular, have come through all of this relatively unscathed. Many of the newer companies are untested in a less positive environment and we may find weaknesses that were hidden during an era when money was available as well as cheap.

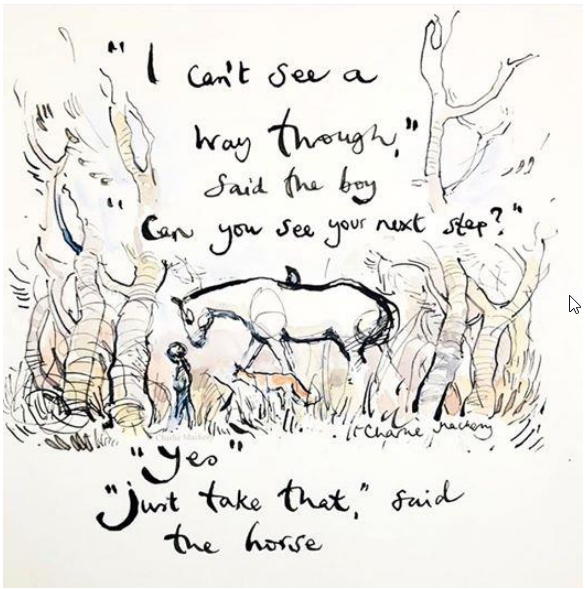

We believe significant risk remains given the continuing number of unknowns. This week could bring some negative surprises as economic statistics and corporate earnings begin to be reported. As shown in the cartoon at the top of this section, when you can’t really see your way forward, the best thing is to take it slowly, one step at a time. That is our current plan.

Sincerely,

Loudon Investment Management, LLC

DML/EJS/JJS/LO

P.S. This was a very difficult letter to write. There is so much going on that we have only scratched the surface. In the course of our regular reading, we came across the note below. It lays out in a very logical way what is going on and alternatives for the future. Though some of the language is somewhat more dramatic than we would have used, we thought it might help place things in perspective for you as it did for us.

On My Mind: Bringing the Economy Back from Life Support , Sonal Desai, CIO Franklin Templeton Fixed Income

- The recession is here and the economy is now on life support. US jobless claims went from almost nothing to about 16 million in the space of 3 weeks.

- This is a very different recession. It has not been triggered by an economic or a financial shock…but by fiat—created by government decree much like a fiat currency. The US government has decided to shut down large parts of the economy overnight, instructing workers and consumers to stay home.

- The key difference with the Global Financial Crisis (GFC) in 2008-2009 lies in the underlying health of the economy. In 2009, the trigger was the unraveling of an enormous multi-layered credit bubble. The financial sector seized up and credit stopped flowing.

- This time the banking sector is in good shape—indeed the government and the Federal Reserve (Fed) are relying on it to keep the economy alive while we fight the virus.

- The key difference with the Great Depression lies in the policy response. In 1929 there was none; in fact, the Fed contributed to the depth of the recession. This time the fiscal and monetary policy responses have been immediate, forceful and well-designed building on the recent experience of fighting the GFC.

- How deep this recession will be—and how difficult the recovery—depends on how long we keep the economy in this kind of artificially induced coma.

- If we can gradually reopen the economy over the course of May, with some acceleration of activity in June, the damage could be limited, particularly if the government keeps providing support to households and businesses.

- The longer the shutdown, the harder, slower and costlier the recovery. And let’s be clear, those that will be most affected are the most vulnerable: the workers who had only started to benefit from the tight labor market, the people with low or hourly wages and very limited savings.

- The more we add to public debt and to the Fed’s balance sheet, the greater the risk that further down the line those imbalances will cause us another set of serious headaches. However, this is not the time to worry about rising public debt–but know that time will come.

- Over the next two or three weeks, the priority should be to identify a strategy to restart economic activity while maintaining sufficient precautions to safeguard public health. If we wait much longer though, the recession will acquire its own momentum and our ability to engineer a recovery will be a lot more limited.